Finance Charges |

Top Previous Next |

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

Finance Charges & Interest on Balances

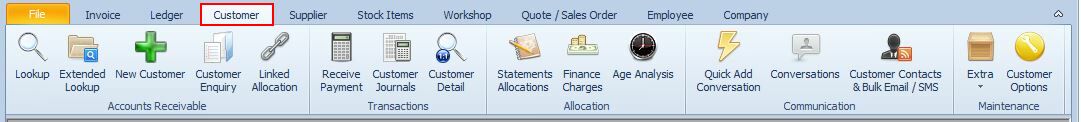

Go to Customer > Finance Charges.

Late Payment Charges & Interest

Finance charges apply to late payments, and interest may be earned on positive balances.

Hover the mouse over the different fields on the form. If the cursor changes to a hand (![]() ) , click to get more information.

) , click to get more information.

To Allocate Column:

Amounts in this column indicate unallocated payments or credits that need to be matched to invoices or debits.

For more information go to Customer > Enquiries.

Interest Calculation Example

Scenario:

•The current month is July.

•Payment terms are 30 days.

•Overdue amounts:

•May & April (already overdue)

•June (due by July 31)

Total |

Current (e.g. July) |

30 Days (e.g June) |

60 Days (e.g May) |

90 days (e.g April) |

1300 |

100 |

500 |

300 |

400 |

How Interest is Calculated:

•If you enter August 1 as the date in the interest form, interest is calculated on R1200 (June + May + April).

•If you use a date in July, interest is calculated on R700 (May + April).

•Typically, the date used is the 1st of the month.

After processing:

➢View Total Interest Charged: Ledger > GL Details

➢View Interest by Client: Customer > Customer Detail (Search "Interest" in the description box)

Reversing Posted Interest

1.Go to Customer > Customer Journals.

2.Select "Adjustment" and "Completed".

3.In the blue search row, type "Interest" in the description box.

4.Double-click the journal entry to open it.

5.Click "Reverse" to undo the interest charge.

Additional Notes

The default contra interest account can be set in Ledger > Account Options > Account Defaults

Related Topics: Payment Due Date and Payment Terms