General Ledger: Account Setup |

Top Previous Next |

Go to Ledger > Accounts Setup

Watch the video: Adding a General Ledger Account

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

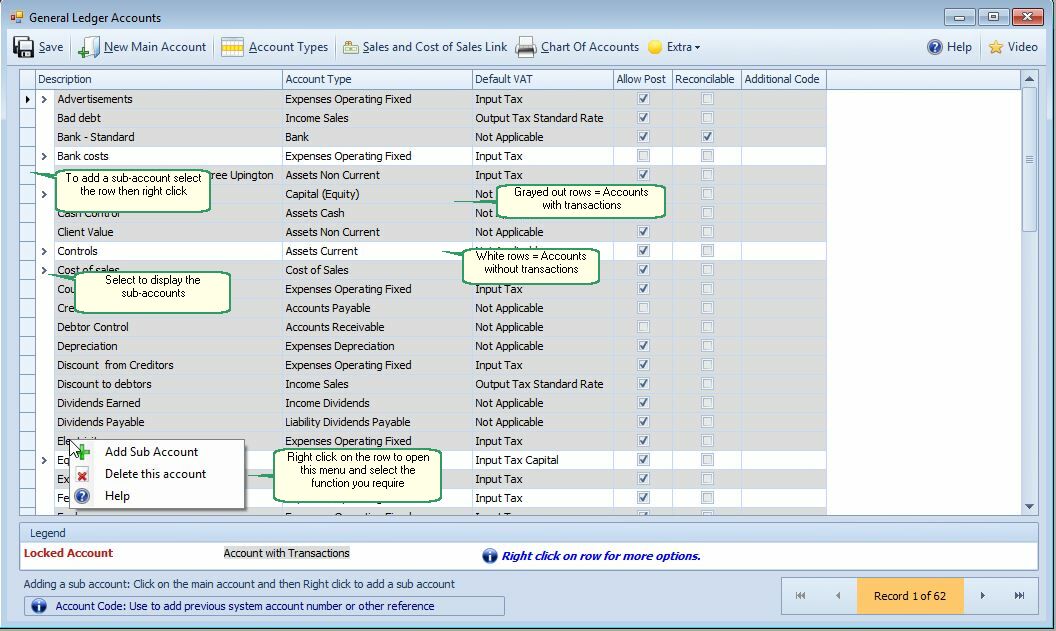

General Ledger Account Setup

Customize your general ledger (GL) accounts in Smart-IT to align with your business needs. For example, rename generic accounts (e.g., "Sales") to specific ones (e.g., "Sales – Computers"). Smart-IT supports creating main accounts and sub-accounts, with sub-accounts totaling into their parent main account. Financial reports can be generated at either the main or sub-account level.

Ledger Account Setup Menu Bar |

|

Save |

Saves any changes made. |

New Main Account |

New GL Main Account Creates a new GL main account. To add a sub-account: 1.Select the main account by clicking its row. 2.Right-click on the row selector and choose Add Sub-Account.

|

Account Types |

Account Types •Opens a list of all available account types. •You can specify the print order on the Trial Balance by dragging and dropping the account types.

|

Sales & Cost of Sales Link |

Sales & Cost of Sales Link •Links a Sales account to a related Cost of Sales account. •This affects how your Income Statement is displayed.

|

Help |

Opens this manual.

|

General Ledger Account Setup -- Extra Menu |

|

Chart of Accounts |

Print or export the Chart of Accounts to Excel.

|

Import General Ledger Accounts |

To import your general ledger accounts: Go to the Extra tab then select Import to import GL accounts.

|

Delete Unused |

Delete Unused GL Accounts Removes unused GL accounts: 1.Select the account by clicking its row. 2.Right-click and choose Delete This Account.

Note:

To consolidate accounts: Use: Corrections GL Account Merge to merge accounts, then delete the merged account if needed.

|

Set All To Not Applicable |

Sets all GL VAT types to Not Applicable.

|

General Ledger Account Setup -- Columns Explained |

|

Description |

The account name.

|

Account type |

Choose from a drop-down list.

|

Default VAT |

Default VAT •Select the applicable VAT type. •VAT types can be created or changed in the TAX Setup module. •Smart-IT also allows default VAT settings for inventory and supplier accounts.

|

Allow Post |

Allow Post •Controls whether postings can be made to the account. •Usually disabled for control accounts (e.g., Debtors, Creditors). •Important: If you use the Budget module, do not post to main accounts with sub-accounts. The budget module use the main account to sum the sub-account values.

|

Reconcilable |

Reconcilable Enable for accounts requiring reconciliation against bank statements (e.g., bank accounts, loan accounts, credit cards). Only reconcilable accounts appear in the Bank Reconciliation form and Cash Journals.

|

Additional Code |

Used for integration with Caseware or Draftworxs. oWhen exporting the Trail Balance to Excel, the Additional Code (entered in the Account Setup) is also exported. oWhen importing the data into Caseware or Draftworx, these codes are used for mapping the accounts.

Important: Obtain the trial balance with linked account numbers from your accountant after finalizing the Annual Financial Statements (AFS) before updating in Smart-IT.

|

Ledger Account Setup - Right-Click Actions

Selecting a Row

•Click on the row selector to choose the account you want to modify.

Adding or Deleting Accounts

•Choose Add Account to create a new account or Delete Account to remove an existing one.

Note: Accounts with transactions cannot be deleted. To remove such accounts, merge them with another account and then delete the merged account.

Change Parent / Make Top-Level

This option lets you convert a sub-account into a main account or move it under another main account.

Converting a Sub-Account to a Top-Level Account

1.Select the sub-account you want to convert.

2.Right-click and choose Change Parent / Make Top Level.

3.A form will open showing the selected account.

4.Check the Top-Level Account checkbox.

5.Click Save and Close.

Linking a Sub-Account to a Different Main Account

1.Select the sub-account you want to move.

2.Right-click and choose Change Parent / Make Top Level.

3.In the dialog window, select the new main account from the list of GL accounts.

4.Click Save and Close.

General Ledger Account Types

General ledger accounts are divided into five categories and split up for reporting purposes (see below).

Code |

A List of Account Types or Accounting Classes in Smart-It |

|

Owner's Equity |

|

Capital is comprised of net income plus the money that the owner originally invested. |

Capital (Equity) |

Cap |

Owner's equity (which includes capital investments and drawings), Opening balance equity, and retained earnings. |

Capital Retained Earnings |

CapR |

Retained Earnings. |

Additional paid-in capital - common |

CapAp |

Money received from investors for common stock. |

Additional paid-in capital - preferred |

CapApp |

Money received from investors for preferred stock. |

Preferred Stock |

CapPS |

Stock whose holders are guaranteed priority in the payment of dividends |

Assets |

Assets represent what an individual or entity owns |

|

Assets CTG |

AssetCGT |

Assets with a capital gains tax implication |

Current Assets |

AssetCA |

Employee Cash Advances, Prepaid Expenses, Allowance for bad debts, Other |

Accounts receivable |

AssetAccRec |

Accounts Receivable (Debtors). Must be used separately to correctly calculate the financial ratios. |

Non-Current Assets (Fixed Assets) |

AssetNC |

Depreciable assets your company owns that aren't likely to be converted into cash within a year, such as Financial Assets, Property, Plant & Equipment, Furniture etc. |

Inventory (Stock) |

AssetI |

Inventory or Stock |

Cash Assets |

AssetCA |

To handle accounts payable (supplier payments) correctly as well as financial ratios |

Intangible Assets |

AssetInt |

Long term: Business properties, such as brands, franchises, trademarks and patents |

Bank |

Bank |

|

Liabilities |

Liabilities represent what is owed |

|

Long Term Liabilities |

LiabL |

Loans and obligations with a maturity of longer than one year, usually accompanied by interest payments. |

Accounts Payable |

LiabAccPay |

Trade and Accounts Payable (Creditors). Must be used separately to correctly calculate the financial ratios. |

Current Liabilities |

LiabC |

Liabilities that are scheduled to be paid within one year, such as sales,sales tax, payroll taxes, accrued or deferred salaries, and short-term loans. |

Liability Leases |

LiabCle |

Leases Payable (current) |

Liability - Dividends Payable |

LiabCdi |

Distributions of earnings to shareholders. |

Liability - Taxes |

LiabCta |

Accrued income, property, and sales taxes payable to city, state, and federal governments. |

Liability - Notes Payable |

LiabCN |

Money that your business owes that will be paid within a year, including bank notes, mortgages, and vehicle payments. |

Income |

Income is money that is earned |

|

Income Gain / Loss on Asset Disposal |

IncAGL |

The gain or loss on disposal of fixed assets |

Income Dividends |

IncD |

|

Income Dividends Foreign |

IncDF |

|

Income Non Operating |

IncNO |

Interest Income |

Income Foreign |

IncF |

Foreign Income |

Income Not Taxable |

IncNT |

|

Income Other Operating |

IncOP |

Rent, Prov. bad debt, Profit On Disposable Assets |

Income Sales |

IncOpSales |

Income from trade. The main source of money coming into your company. |

Expenses |

Expense is money that is spent |

|

Cost of Sales |

COS |

The cost of goods and materials held in inventory and then sold. |

Direct Material Cost |

CosDir |

Direct materials cost the cost of direct materials which can be easily identified with the unit of production. |

Cost of Sales - Direct Labour costs |

CosLab |

|

Expenses Depreciation |

ExpeDep |

|

Expenses Income Tax |

ExpeIT |

|

Expenses Non-Operating |

ExpeNOP |

Example: Interest |

Expenses Operating |

ExpeOP |

An expense incurred in carrying out an organization's day-to-day activities, but not directly associated with production. |

Expenses Other |

ExpeOT |

Rearrange General Ledger Accounts

Rearrange Accounts by dragging and dropping. The order displayed will be used in the trial balance.

To rearrange the accounts go to Ledger > Account Setup and select Account Type on the menu bar. Click on the row and drag.