General Ledger: VAT (Value added Tax) |

Top Previous Next |

Go to Ledger > Tax Report

![]()

![]()

Value Added Tax (VAT) Report in SI+

The VAT Report allows businesses to generate and review VAT calculations for a selected period.

Show Report will open the following form, if your tax system is not South African the Summary tab will open.

1. Generating the VAT Report

•Select your VAT period dates.

•Click Show Report to generate the VAT summary.

Note:

•If your VAT system is not South African, the Summary tab will open instead.

•Transactions not captured in previous periods will be included in the selected period.

2. Capturing VAT Data for the Period

Once the report is reviewed:

1.Click "Click to Capture Data for This Period".

2.SI+ will generate a period number for this specific VAT capture, starting from 1.

3.All VAT transactions in the General Ledger Detail will be assigned this period number.

4.The VAT Reconciliation column in the GL Detail will reflect this number.

3. Posting VAT Data

After capturing VAT data:

•An Adjustment Journal will be created.

•If everything is correct, click Post to finalize the journal.

•Accounting impact:

•VAT Input & Output figures will be transferred to the VAT Control account.

•When VAT is paid, the contra account will be VAT Control, ensuring a balance of zero after tax payment.

To reverse the captured data, use the Delete Button. Remember, the journal that was made during the Capture will not be reversed this must be done by hand - see corrections

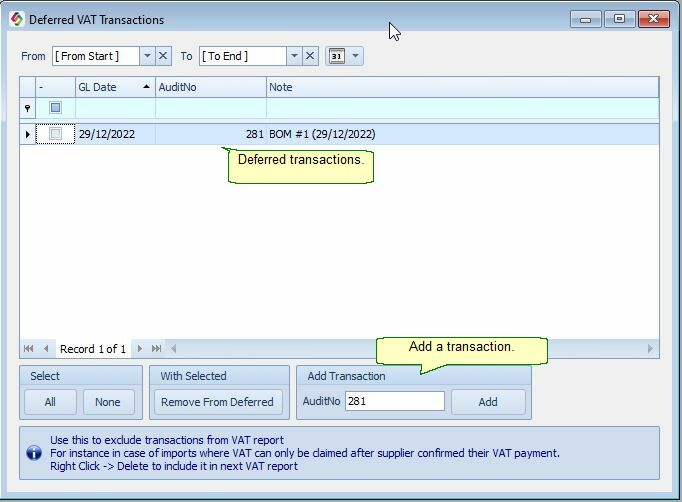

Tax Report: Deferred VAT Transactions

You can defer VAT transactions that should not be included in the current tax period.

Where to Do It:

How to Defer a Transaction:

•Open the VAT Detail Tab

•Select the transaction(s)

•Mark them as Deferred

Notes:

✅ Deferred VAT will not appear in the current VAT report

⛔ Deferred VAT has no effect on your income statement