Age Analysis |

Top Previous Next |

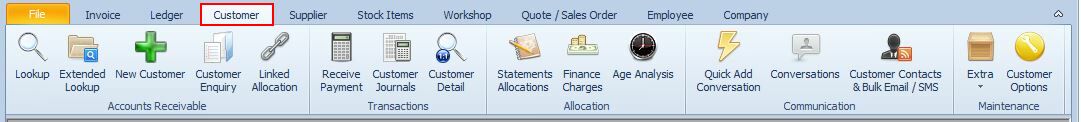

Go to Customer > Age Analysis

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

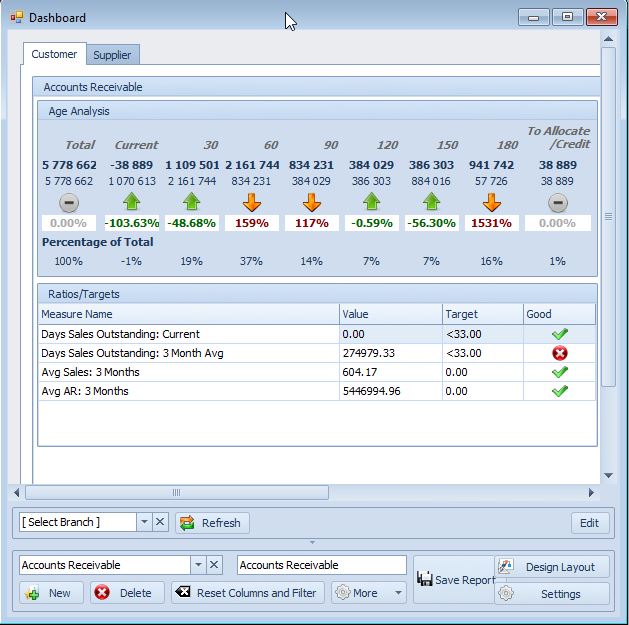

Age Analysis (Accounts Receivable)

An Accounts Receivable Age Analysis helps you track unpaid customer invoices based on how long they’ve been outstanding.

Hover the mouse over the different fields on the form. If the cursor changes to a hand (![]() ) , click to get more information.

) , click to get more information.

Age Analysis Columns Explained |

Current / 30 / 60 / 90 / 120 / 150 / 180+ Shows how long the amounts have been outstanding (in days). Example: The “180” column means the invoice is unpaid for 180 days or more.

|

To allocate: •Displays unallocated amounts that can still be matched to invoices. • |

Due Amount •Calculated based on the customer’s payment terms. •Example: Total: R12,243.19 – R2,287.64 (Current + 30 days) = Due: R9,955.55 |

Terms Days Displays the customers payment terms with your company Assign a customer's payment terms at Customer > Financial Info

|

Tip: Write Off an Amount

Quickly write off small amounts (e.g., unpayable interest) without using Customer Journals:

•Double-click on the age column field → enter amount to write off.

•Journal Entries:

•Debit: Bad Debt

•Credit: Debtor Control

•Set the default bad debt account in: Ledger > Account Options

✅ You can also right-click the field for options.

What You Can Learn from Age Analysis

1.Outstanding Balances – View total unpaid amounts by aging periods.

2.Payment Trends – Track how long customers take to pay.

3.Credit Risk – Identify risky customers based on overdue patterns.

4.Problem Detection – Spot bad debts or consistent delays.

5.Collection Efficiency – Measure how well your team is collecting.

6.Decision Support – Help adjust credit limits or follow-up strategy.

7.Customer Segmentation – Group customers by behavior or risk.

Bonus Features from Age Analysis Form

•Send bulk emails or SMSes directly.

•Suspend or Unsuspend customers.

•Allocate unallocated payments.

Key Metrics to Track from AR aging Reports.

Go to File > Dashboard

https://bit.ly/SI_Age_Analysis