Ledger: Cash Journal |

Top Previous Next |

Go to Ledger > Cash Journal

Hover the mouse over the different menu options. If the cursor changes to a hand (![]() ), then click to go to the subject.

), then click to go to the subject.

![]()

![]()

Cash Journal

The Cash Journal is used to record all cash receipts and expenditures, helping to manage the company's cash flow.

•Cash payments to suppliers → Go to Supplier > Supplier Journal and select New Payment

•Customer payments → Go to Customer >Customer Journals or Customer > Customer Receipts

Lookup & Reversal of Journals: 1) Show Type: Choose between showing Payments or Deposits. 2) Show Completion: To recall a completed journal. 3) Reversing a Journal: o You can reverse (delete) a journal if needed. o Note: You cannot reverse a journal where Bank Reconciliation or Tax has been done.

For more on corrections, click here. |

Starting a New Journal

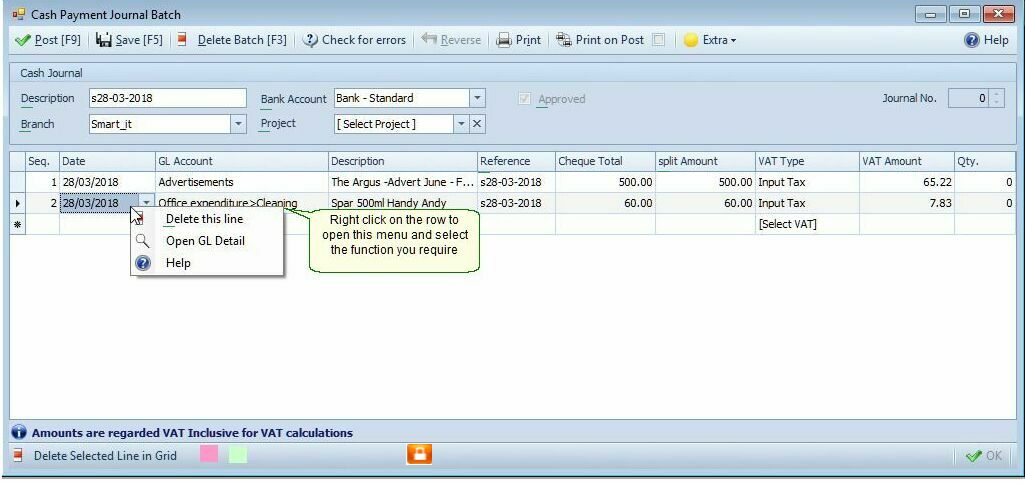

To start a new journal, choose between (see image above):

•New Withdrawal (Payments)

•New Deposit

The corresponding form will then open.

Hover the mouse over the different fields on the form. If the cursor changes to a hand (![]() ) , click to get more information.

) , click to get more information.

Cash Journals

Note: •To pay a supplier, go toSupplier > Supplier Journal and select New Payment. •If the payment was made from the cash register, the General Ledger account must be your Cash Control account to ensure the money reflects in your Cash Up. •If the expenses were paid out of the till, you will record it in the Cash Up module.

If it was a payment received from a customer you must record it in Customer > Customer Journals > New Payment Received or under Customer > Receive Payment. |

Import/Export Cash Journal

To Import or Export a Cash Journal open the Cash Journal and click on the Extra Menu button

To establish an approval process for the cash journal:

•Clerk's Role: The clerk can capture the journal entry (New withdrawal/payment or New deposit), but cannot post it, as it requires approval from a Manager. On the clerk's screen, the Post and Approval options will be greyed out.

•Manager's Role: The Manager reviews and approves the journal entry. However, the Manager is also unable to post it; only the Auditor can do so. On the Manager's screen, the Post option will be greyed out.

•Auditor's Role: The Auditor is responsible for posting the journal entry after it has been approved by the Manager. On the Auditor's screen, the Approval option will be greyed out.

Each step of this process is controlled through security settings, ensuring that each person can only perform their designated function.

Alternatively, you can enable one person to both approve and process the entries. In this setup, the clerk captures the data while the Manager handles both approval and processing.

Setting Cash Journal Approval:

1.Go to Ledger > Account Options.

2.Select the Restrictions & Options tab.

3.Check the box labeled 'Do cash journals need approval'.

•If this box is unchecked, the Process and Approval checkboxes will be hidden.

Setting Up Security for Cash Journal

1.Select Cash Journal in the Ledger (ensure the form is open before setting the security).

2.Go to your Security settings and assign each person to their appropriate group with the following permissions:

•Clerk: Not allowed to approve or process.

•Manager: Only allowed to process.

•Auditor: Allowed to process but cannot change approval status or edit.

Only accounts marked as Reconcilable in the General Ledger > Account Setup will be displayed here.

Tip: Mark the petty cash account as reconcilable if you make many payments from it. This will save you time by eliminating the need for an adjustment journal that requires two entries.

Print on Post

If selected the batch will automatically print.